Expert Reviews Analysis. RM 63000 RM 1400 RM 9000 RM 4400 RM 48200.

Pin By Asn Corporate Consultancy On Tax Relief 2017 Relief Inbox Screenshot

Based on Section 461qa of Income Tax Act 1967 breastfeeding equipment refers to a breast pump kit and an ice pack a breast milk collection and storage equipment.

. Qualified For Tax Relief Integer 2 Enter the number of children old and married qualified for claim on tax relief. Ad See the Top 10 Tax Relief Services. TAX DEDUCTION RELIEF AND REBATE Year of Assessment 2009 LHDNM-R00710 Junaidi Caw.

LEMBAGA HASIL DALAM NEGERI MALAYSIA. Guys there are two sections that you can claim Lifestyle expenses F8 and F9 Each section you can claim a maximum of RM2500. Did you know that you can also enjoy tax relief for your medical insurance premium.

You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. Last updated October 15 2021 IRB or LHDN Tax Planning By Michelle Liew. Cant Pay Unpaid Taxes.

BBB Accredited A Rating - Free Consult. Relief From Stamp Duty. End Your Tax NightApre Now.

Talk Now to Get Your Relief Options. Ad Get Your Tax Relief Qualifications. Malaysia Income Tax Relief for 2017.

Technical or management service fees are only liable to tax if the services are rendered in Malaysia. Below is the list of tax relief items for resident individual for the assessment year 2019. Income tax rebates for resident Individual are tabled below.

It is a combination of the tax relief for reading materials up to RM1000 a year computer up to RM3000 every three years and sports equipment up to RM300 a year. Trusted by Over 1000000 Customers. Trusted Tax Resolution Professionals to Handle Your Case.

Relief Entitled to claim Not entitled to claim Rebates Entitled to claim rebate under subsection 6A2 of. 2017 2017 N - 1 - This Explanatory Notes is. As the clock ticks for personal income tax.

Ad Do You Owe Over 10K in Back Taxes to the IRS. F8 F9 F10 F8 Lifestyle 15 Purchase of breastfeeding equipment for own 16. BBB Accredited A Rating - Free Consult.

42 Tax treatment of resident and non-resident individuals. As such the changes and additional tax relief for the assessment year 2017 are as below. B 2017 EXPLANATORY NOTES.

Lets say you have. Ad Do You Owe Over 10K in Back Taxes to the IRS. Ad End Your IRS Tax Problems.

Defend End Tax Problems. For this post I will be sharing on preparation for 2017. Expert Reviews Analysis.

482010 110236 AM. This guide is for assessment year 2017Please visit our updated income tax guide for assessment year 2019. The gobear complete guide to lhdn income tax reliefs malaysia are you actually paying a lot more if go for 8 personal 2019 ya 2018 money malay mail foreign employees in china individual how.

For tax rebate keyword is rebate not reduce taxable income max rebate from zakat is what tax paid for the year. Relief up to 96. 24 rows Tax relief refers to a reduction in the amount of tax an individual or company has to.

Possibly Settle For Less. Ad Trusted A BBB Member. Ad 5 Best Tax Relief Companies of 2022.

2 Tax Relief for Purchase of breastfeeding equipment Limited to RM1000. LHDNIRB Personal Income Tax Relief 2020. Compare the Top Tax Relief Services and Find the One Thats Best for You.

JOINT MEMORANDUM ON ISSUES. Biasanya perbicaraan diadakan di bandar di mana Pejabat Lembaga Hasil Dalam Negeri yang mengendalikan fail. Ad End Your IRS Tax Problems.

LHDN01354251179-1 Page 1 of 4 GUIDELINES ON INCOME TAX EXEMPTION FOR RELIGIOUS INSTITUTION OR ORGANIZATION UNDER THE INCOME TAX EXEMPTION ORDER 2017 PU. The relief amount you. Personal tax relief Malaysia 2020.

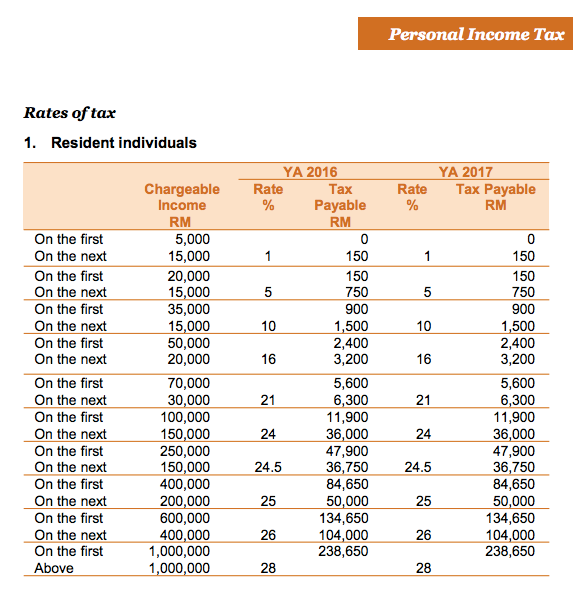

Amendments To The Stamps Act 1949. A ringgit tax rebate will worth more to you than a ringgit of tax relief. While the 28 tax rate for non-residents is a 3 increase from the previous years.

The purchase of breastfeeding equipment to be used for a child aged two years old and below can save you a maximum of RM1000 in tax exemption as announced during the. Get Instant Recommendations Trusted Reviews. Here are some tips on what you can do to save money in Malaysia through tax relief.

Get Tax Relief from Top Tax Relief Services. Find Out Now For Free. Personal tax relief is subject to eligibility and approval of Inland Revenue.

A much lower figure than you initially though it would be. For Year Of Assessment 2021 please refer to amounts in. Total annual income Tax Exemptions Tax Reliefs.

Number of children 2. Trusted by Over 1000000 Customers. Responsibilities Rights of Individual.

6 New S461q Tax Relief for the Purchase of Breastfeeding Equipment 12 7 New S461r Tax Relief for Fees Paid to Child Care Centres and. Get Tax Relief from Top Tax Relief Services. If you pay 2000 tax in 2021 you can get rebate from zakat.

PwC 20162017 Malaysian Tax Booklet Income Tax 5 Public rulings and advance rulings To facilitate compliance with the law the DGIR is empowered to issue public rulings and advance.

Malaysia Personal Income Tax Guide 2019 Ya 2018 Ringgitplus Com

Malaysia Personal Income Tax Guide 2019 Ya 2018 Ringgitplus Com

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Jobs Career Malaysia Epsmalaysia Twitter

Income Tax Of An Individual Lembaga Hasil Dalam Negeri

Things That Can Get You In Trouble With The Tax Authorities

Tax Relief For Year Of Assessment 2018 Plctaxconsultants

Pin By Asn Corporate Consultancy On Tax Relief 2017 Hiburan Lagu Belajar

Malaysia Personal Income Tax Guide 2019 Ya 2018 Ringgitplus Com

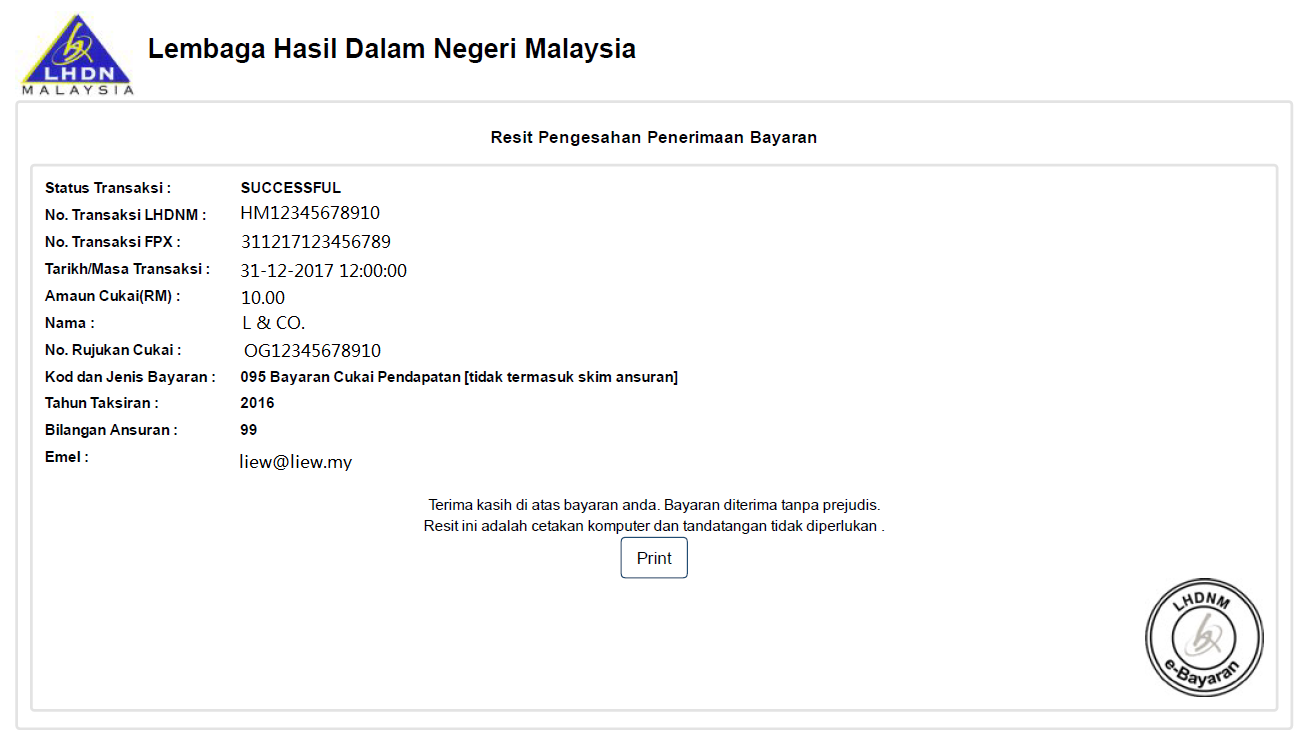

Tips For Income Tax Saving L Co Chartered Accountants

Taxrelief2020 Twitter Search Twitter

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium

2020 Tax Relief What To Claim For Your Tax Deductions R Malaysia

Malaysian Income Tax 2017 Mypf My

Lhdn Irb Personal Income Tax Relief 2020

Income Tax Relief For Lhdn E Filing 2022 Ya 2021 Joy N Escapade

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Keeping Book Receipts With Amazon Kindle For Tax Relief In Malaysia

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium